research

Links to working papers will be uploaded in due course. Till then, please reach out out via e-mail and I will be happy to share research drafts.

2025

-

The Inequality Multiplier: Market Inelasticity and the Persistence of Wealth InequalityCharles Christopher Hyland and Aditya Khemka2025

The Inequality Multiplier: Market Inelasticity and the Persistence of Wealth InequalityCharles Christopher Hyland and Aditya Khemka2025Saïd Foundation Award for Best Doctoral Paper in Finance, 2025

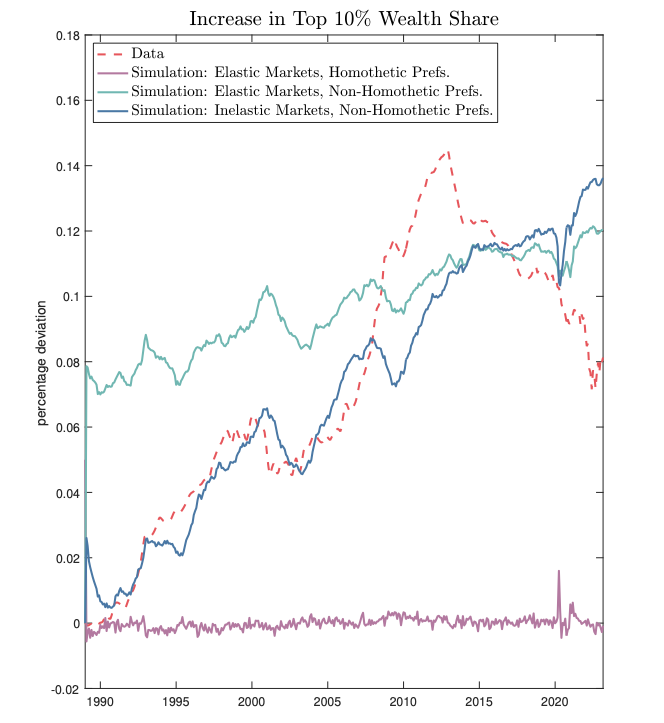

We study how recent changes in equity market macrostructure shape U.S. equity market capitalization, aggregate debt levels, and wealth inequality. Rising income inequality, combined with inelastic markets, drives persistent wealth disparities through asset price revaluation—a mechanism we term the “inequality multiplier.” Using a general equilibrium model, we identify two channels: (i) the equity investment channel, where wealthy households’ higher propensity to save amplifies equity price booms; and (ii) the borrowing channel, where increased indebtedness raises equity prices via rebalancing demand from financial intermediaries. Calibrating the model to U.S. data, we show that this multiplier makes wealth inequality self-perpetuating and drives a growing wedge between income and wealth inequality. The model replicates observed trends in equity prices, debt levels, and wealth concentration, revealing how asset market frictions drive inequality beyond existing explanations. The equity investment channel shapes long-run trends, while the borrowing channel explains short-run cycles in wealth inequality. Our findings link recent shifts in financial market structure to macroeconomic outcomes.

AFA Annual Meeting Poster Session (January 2026), Bank of England Macro Brown Bag (July 2025); Asian Finance Association, Taipei (June 2025); Trans-Atlantic Doctoral Conference, London Business School (June 2025); Rethinking Economic Theory Conference, Athens (December 2024)

-

Green Policy, Unequal OutcomesAditya Khemka and Dimitrios P. Tsomocos2025

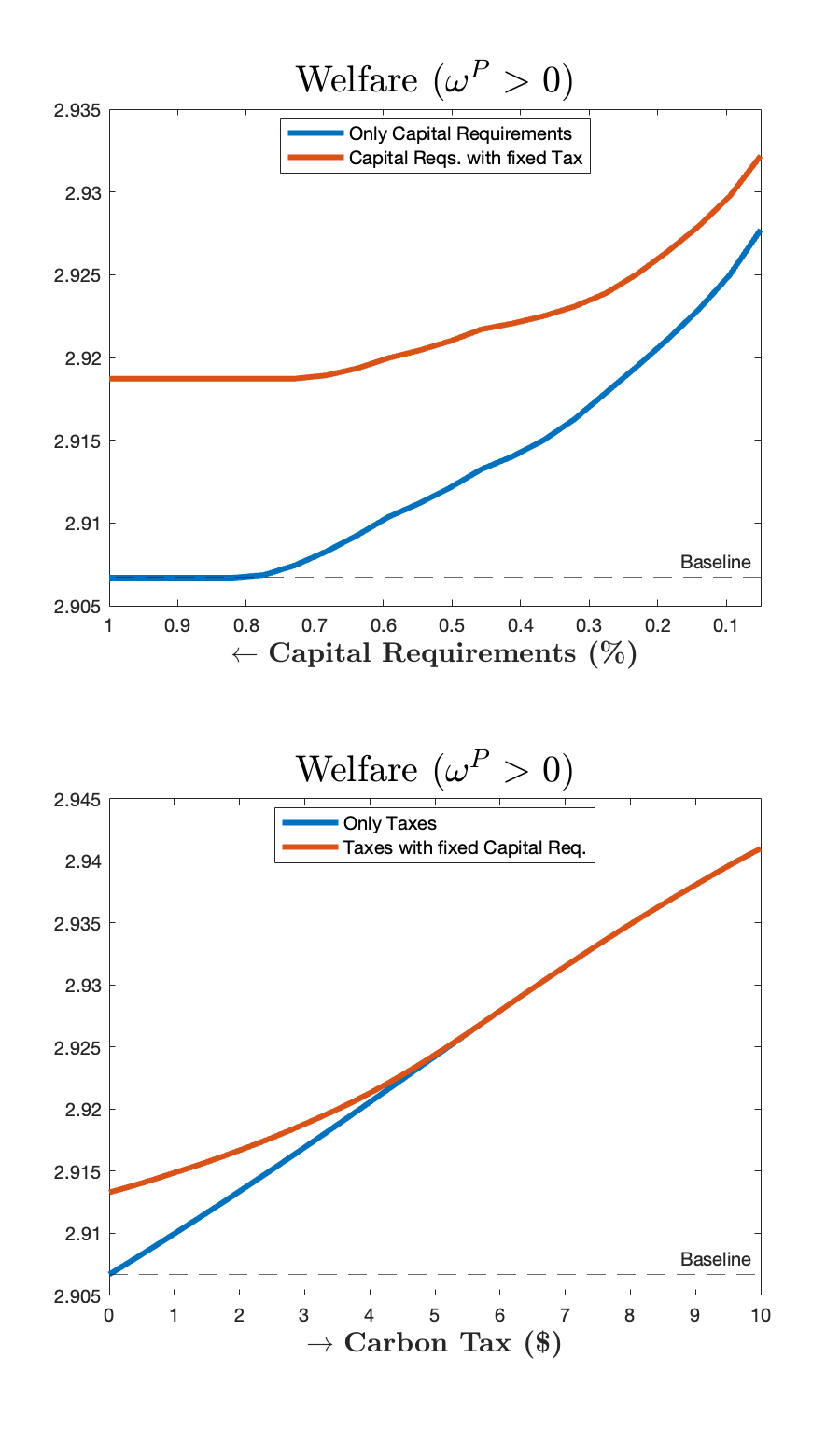

Green Policy, Unequal OutcomesAditya Khemka and Dimitrios P. Tsomocos2025We investigate how climate-focused financial regulations impact wealth inequality and economic welfare. Who loses on the climate transition path and/or due to environment policy? Which trade-offs should policy makers address? We develop a two-period general equilibrium model with heterogeneous households, incomplete markets, and endogenous climate damages to assess the effects of green capital requirements and carbon taxes. Our findings reveal that while green capital regulations reduce pollution, they also constrain credit allocation, lowering aggregate efficiency and amplifying wealth inequality through labor market distortions. We identify a fundamental trade-off: policies that effectively mitigate environmental harm tend to increase inequality, while those that reduce inequality often fall short in addressing climate risks. We show that carbon taxes outperform green capital regulations in reducing emissions and cause a smaller rise in inequality. Empirical evidence supports these findings, particularly in developed economies where credit contraction exacerbates distributional disparities. Our results highlight the need for policymakers to balance environmental goals with equity considerations in designing climate policy.

Bank of England Financial Stability Seminars (September 2025), Bank of England PPD Research Discussion Group (May 2025); Oxford Saïd - VU SBE Macro-finance Conference, Oxford (June 2024); IV Central Bank Conference on Environmental Risks, Mexico City (December 2023)

-

Climate change, macroprudential policy responses and their distributional consequences in South AfricaAditya Khemka, Christina Laskaridis, and Dimitrios P. TsomocosSouth African Reserve Bank Working Paper Series, 2025

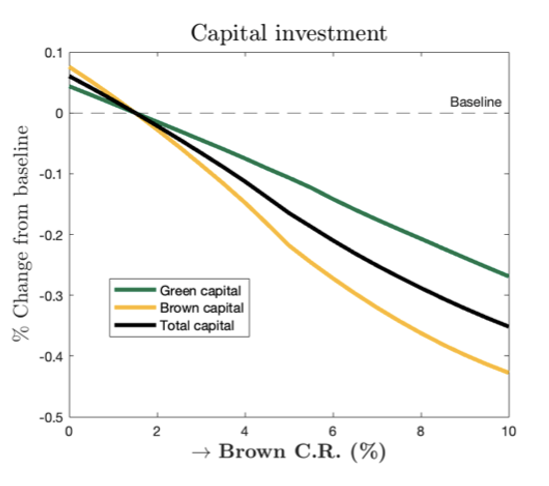

Climate change, macroprudential policy responses and their distributional consequences in South AfricaAditya Khemka, Christina Laskaridis, and Dimitrios P. TsomocosSouth African Reserve Bank Working Paper Series, 2025In transitioning from coal-dependent growth to a low-carbon economy, South Africa faces intertwined environmental, macro-financial and distributional risks. We build a two-period computable general equilibrium model with heterogeneous households, firms and a dual- tier banking system, embedding endogenous default, brown and green capital markets and a pollution-damage feedback. After calibrating to South African data, we compare three instruments – downstream carbon taxes, brown risk-weighted capital surcharges and green capital discounts – individually and jointly. Carbon taxation most sharply curbs emissions and, when revenues are rebated to workers, also narrows wealth and consumption inequality. Brown penalising factors restrain leverage and reduce default probabilities but raise energy prices and widen wage inequality; green supporting factors lower financing costs yet trigger a Jevons-type rebound that can increase coal demand. Welfare decompositions show that no single tool dominates; the optimal approach involves pairing a carbon tax with prudential tweaks that balance climate gains, stability and equity for South Africa.

Committee of Central Bank Governors in SADC (CCBG) Climate Change Policy Dialogue, Lusaka (July 2025)